We believe the tide has turned in uranium and we are entering the next nuclear renaissance. Industry fundamentals are improving at a rapid pace, with increasing policy support from governments, a re-contracting cycle by western utilities, and a supply side not yet incentivised to significantly increase production – all of which sets the stage for a positive medium-term outlook.

Given the global focus on green energy initiatives, we believe nuclear power has a significant role to play in the future energy mix, as it delivers minimal carbon emissions in addition to being a reliable source of base-load power to complement renewable energy sources, including solar and wind. In addition, public support for nuclear continues to grow as people directly experience the reality of disrupted and/or expensive forms of electricity supply.*

Growing political support

2022 was a watershed year in the political landscape supporting nuclear energy given the increasing need for energy security. In the US, we have seen the Inflation Reduction Act (August 2022) support nuclear power as a clean energy source, the Civil Nuclear Credit Program (November 2021) support the existing US reactor fleet and introduction of the US Federal Strategic Uranium Reserve (first purchases announced in December 2022). In Europe, the inclusion of nuclear energy in the EU Taxonomy (July 2022) represents a pivotal turning point with Europe formally accepting nuclear as green energy. In addition, Japan and Korea both launched green taxonomies during 2022 which included nuclear in addition to bringing their nuclear fleet back online and reversing phase-out programs. In Australia we have even seen the re-emergence of the nuclear debate.

The support for nuclear supply certainty is further exacerbated by potential government interventions and the increasing bifurcation of geopolitical tensions between the East and West. The largest global uranium producer is Kazakhstan, with Kazatomprom being 75% state owned, followed by Canada and Namibia, with the later having material Chinese interest. As a result, fuel buyers are becoming increasing focused on the source of origin for long-term contracting.

Uranium production (U308 tonnes) across countries (2013–2022)

Source: World Nuclear Association, May 2023. www.world-nuclear.org/information-library/facts-and-figures/uranium-production-figures.aspx

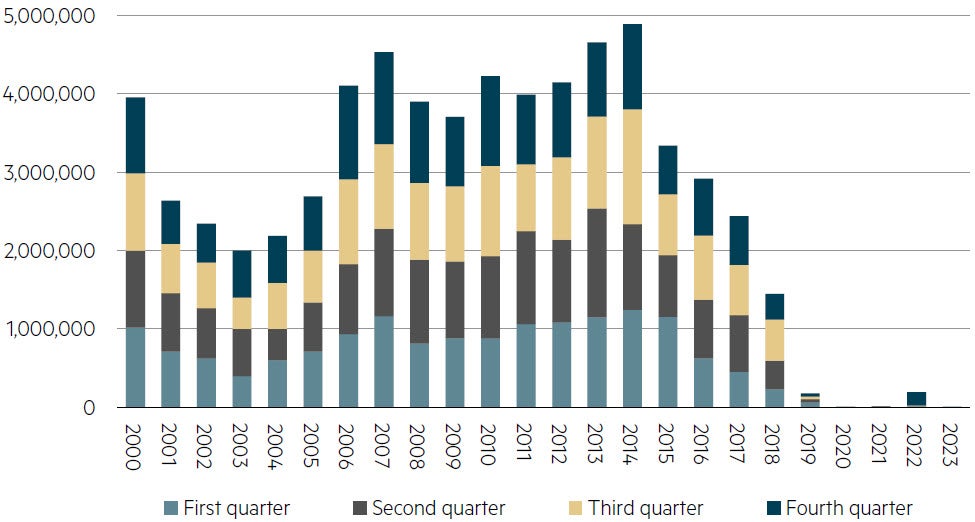

The US has historically been increasing dependence on cheap uranium imports from the East at the expense of domestic production which is almost non-existent now. This is despite approximately 20% of US utility-scale electricity generation being derived from nuclear energy.

Uranium concentrate production (U308 pounds) in the United States, 2000 to first-quarter 2023

Source: U.S. Energy Information Administration: Form EIA-851A, Domestic Uranium Production Report (Annual), and Form EIA-851Q, Domestic Uranium Production Report (Quarterly), data withheld during 2020 and 2021, 18 May 2023. www.www.eia.gov/uranium/production/quarterly/

Increased need for energy security

The Russian invasion of Ukraine is driving a desire for greater energy security. Russia represents 14% of global uranium capacity and has dominance of the downstream fuel processing industry with 27% of global conversion capacity and 39% of global enrichment capacity.** Russian exports of enriched uranium have ~28% market share in the US.*** To offset Russian reliance, US lawmakers are currently seeking to introduce the Nuclear Fuel Security Act of 2023 which would support the establishment of domestic nuclear fuel production. In addition, the House Energy & Commerce Committee the Prohibiting Russian Uranium Imports Act on 24 May to ban imports of low-enriched uranium from Russia (although it still must pass in the US House and Senate). The US Senate has recently introduced the ADVANCE Act (‘Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy of 2023’) which is intended to strengthen America’s interest in nuclear energy by investing in technologies and improving infrastructure and supply chains.

While multiple sanctions have been imposed on Russian uranium products, we are yet to see these meaningfully flow through to the uranium fuel cycle given the critical importance of the commodity. In addition, we have only seen selective self-sanctioning from US utilities as many continue to take delivery of Russian-sourced enriched uranium from legacy contract arrangements.

We believe the following three recent major developments may result in western utilities increasing their focus on security of supply and potentially drive urgency in securing supply from ‘friendly’ sources:

- Kazatomprom announced a sale of a 49% stake in the country's second-largest uranium deposit to subsidiaries of Rosatom, a Russian state-owned entity, which gives Rosatom access to a significant mining operation under development in Kazakhstan.

- Kazatomprom requiring shareholder approval for a long-term supply contract with a subsidiary of China National Nuclear Corp. (CNNC) with the value being more than 50% of the current total book value of Kazatomprom's assets and the allowance for other transactions in the future.

- We see increasing risk of government interventions potentially leading to supply uncertainty.

‘Nuclear power is firmly entrenched as a critical part of the strategy to reduce carbon emissions… production in 2023 is vulnerable to sanctions, shipping disruptions and supply chain risk… production does not respond quickly to price’ Boss Energy, ASX release from company presentation, May 2023.

Drivers of increased demand

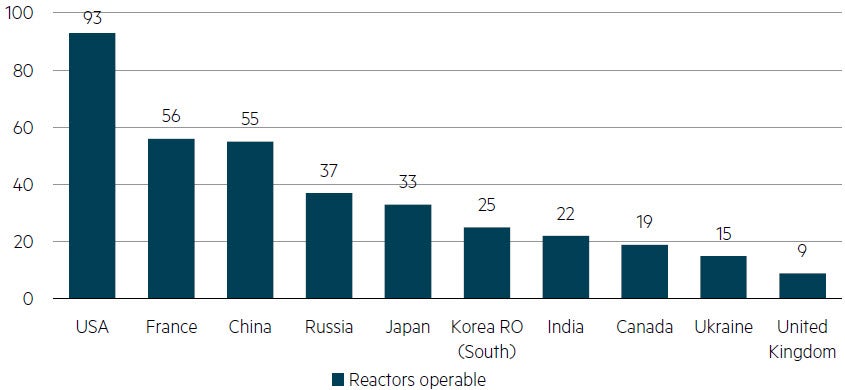

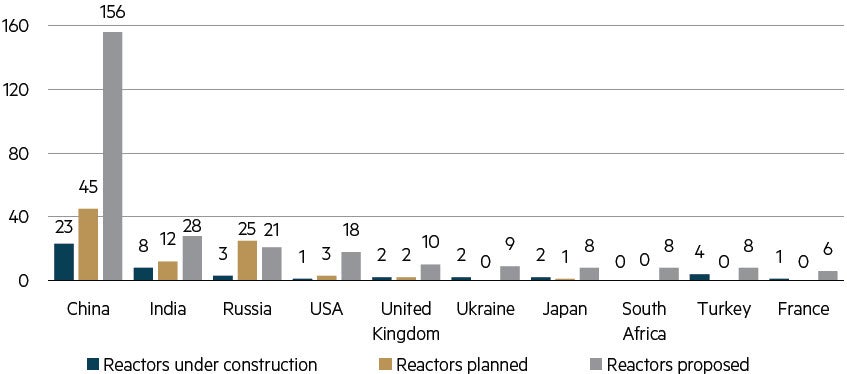

Uranium demand is increasing in the short-term given the reversal of early nuclear plant retirements and geopolitical tensions, coupled with a strong medium-term outlook given the global focus on clean energy, new reactor builds and development of small modular reactors. As at April 2023, there were 436 reactors in operation, 59 under construction, 100 planned and 325 proposed.

Reactors operable (top 10 countries)

Source: World Nuclear Association, World Nuclear Power Reactors & Uranium Requirements May 2023, Reactor and electricity data: International Atomic Energy Agency Power Reactor Information System (PRIS); US Energy Information Administration; company data; World Nuclear Association estimates. www.world-nuclear.org/information-library/facts-and-figures/world-nuclear-power-reactors-and-uranium-requireme.aspx

China’s pipeline of new nuclear builds is the size of the rest of the world combined and is expected to overtake the US by the end of the decade. This build-out reflects China’s recognition that nuclear is a core pillar in its emissions reduction strategy.

Reactors under construction, planned and proposed (top 10 countries by reactors proposed)

Source: World Nuclear Association, World Nuclear Power Reactors & Uranium Requirements May 2023, Reactor and electricity data: International Atomic Energy Agency Power Reactor Information System (PRIS); US Energy Information Administration; company data; World Nuclear Association estimates. www.world-nuclear.org/information-library/facts-and-figures/world-nuclear-power-reactors-and-uranium-requireme.aspx

Supply characteristics

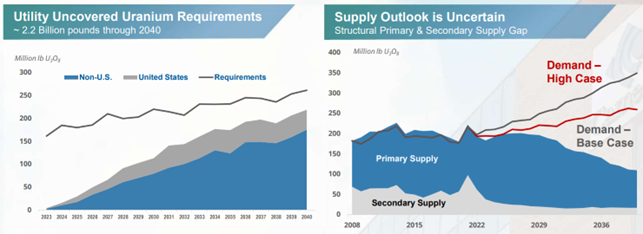

A structural supply gap is expected to emerge by the end of the decade with upside risk driven by:

- Disciplined supply with a number of uranium mines closed over the past decade;

- A vast reduction in supply from secondary sources (nuclear disarmament programs);

- Enrichment capacity constraints resulting in overfeeding due to geopolitical issues;

- Aggressive buying by financial buyers sequestering uranium inventory (e.g. Sprott Uranium Trust, Yellowcake Plc, ANU Energy and Zuri-Invest); and

- Utilities contracting above replacement levels.

Uranium market outlook

Source: Cameco Q1 2023 Conference Call, UxC Q1 2023 Uranium Market Outlook.

We believe we're at the start of a term contracting cycle with utilities holding significant uncovered stock positions. There are signs so far this calendar year that long-term contracting levels are starting to approach replacement levels with upside risk to utilities building new inventories. According to Cameco, the uranium price has never been this high at this early stage of the cycle, with the implication that there are further price rises to come if contracting activity plays out as expected.

‘Demand for nuclear power is driving the best fundamentals we have ever seen for the nuclear fuel market. We have never seen the early stage of the contracting cycle start at such high prices’ Cameco Q1 2023 Conference Call, April 2023

Unlike previous cycles, producers are displaying measured supply discipline with idled capacity restarts being staged and typically underpinned by long-term contracts. Restarts include:

- Cameco’s McArthur River restarted in late 2022 with a measured ramp-up profile, being 15mlbs pa expected in 2023 and 18mlbs pa in 2024 versus full capacity at 25mlbs pa;

- Boss Energy expected to restart the Honeymoon project in the December 2023 quarter ramping up to 2.45mlbs pa by the start of its third year; and

- Paladin Energy expected to bring on Langer Heinrich in the March 2024 quarter, ramping up to full capacity of 6.0mlbs pa by the start of its third year.

Additional industry capacity is reliant on new project developments which are longer dated.

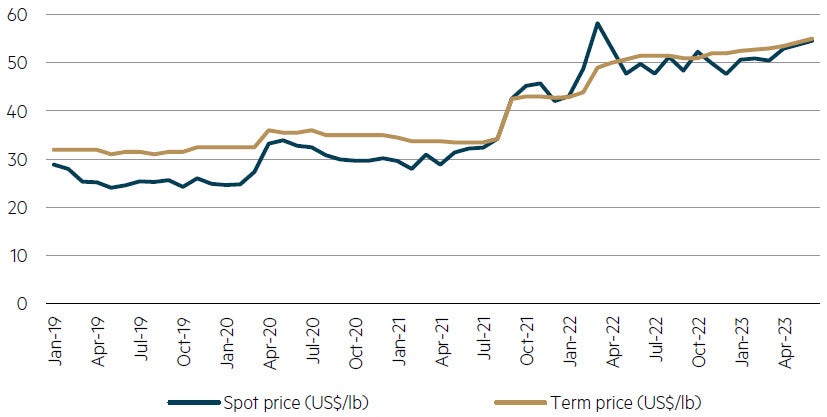

Uranium price action

Based on MBA estimates and given the staged nature of restarts to date, we expect a step-change in the uranium term price to incentivise new project developments over the medium-term with a potential price in excess of US$80/lb due to marginal production costs and project cost inflation. Other components of the nuclear fuel cycle have shown greater price appreciation to date, including conversion and enrichment, potentially providing a good lead indicator for uranium prices.

Uranium price – spot vs. term contracts (US$/lb)

Source: Cameco website, Cameco calculates industry average prices from the month-end prices published by UxC and TradeTech. www.cameco.com/invest/markets/uranium-price

Playing the Australian small cap uranium sector

We see significant medium-term value upside for the uranium sector, with companies restarting projects expected to benefit most in the short-term, for example, Boss Energy (ASX code: BOE). Boss Energy is expected to restart its uranium mining operation at its ‘Honeymoon Uranium Project’, which is located in the geopolitically friendly jurisdiction of South Australia, in the December 2023 quarter., The company is fully funded (~A$100m net cash with ~A$100m strategic inventory) and production is scheduled to ramp up to 2.45mlbs pa within three years, with upside to both production levels and mine life through adding existing resources to the mine plan and exploration on near-mine tenements.^ The main risk is project commissioning, which has de-railed a number of new mines in the past few years. However we consider that this risk is partly mitigated in relation to Boss Energy as the project has operated previously, so has a track record of processing uranium material in the past, and the strong excess liquidity position that it is in. Provided ramp-up goes to plan, the company is well positioned to take advantage of the expected upswing in uranium pricing given minimal long-term contracts have been locked in to date.

In conclusion, we see nuclear power playing a critical role in the future energy transition, given the increasing importance of energy security and positive structural market fundamentals. In our view, the uranium price needs to rise to a level closer to US$80/lb in order to incentivise sufficient production to satisfy market demand.

* American Climate Perspectives Survey 2022, Vol. III, Support for Nuclear, Wind, and Solar Trending in 2022, ecoAmerica, September 2022, https://ecoamerica.org/american-climate-perspectives-survey-2022-vol-iii-blog/, 2023 National Nuclear Energy Public Opinion Survey, Bisconti Research, Inc., May 2023, https://www.bisconti.com/blog/public-opinion-2023, Szazadveg Alpitvany, Europa Projekt, January 2023, https://szazadveg.hu/hu/2023/01/04/novekszik-az-atomenergia-tarsadalmi-tamogatottsaga-europaban~n3421?fbclid=IwAR3tvN5HSHFjHEcrOIPlHFmWAUxambulCpASvLqpc27g2IPQhr-YbjVoqUU, The French and Nuclear: Knowledge and Perceptions, Orano, June 2021, https://www.orano.group/docs/default-source/orano-doc/presse/dossiers-presse/les-fran%C3%A7ais-et-le-nucl%C3%A9aire/les-franc-ais-le-nucleaire.pdf.

** Cameco Q1 2023 Presentation, 2022Q1 UMO, CMO and EMO Data – Base Supply from Russia.

*** U.S. Energy Information Administration, Form EIA-858, Uranium Marketing Annual Survey (2017–21), https://www.eia.gov/uranium/marketing/table16.php.

^ Boss Energy ASX presentation release, May 2023.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 2 June 2023 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2023 Maple-Brown Abbott Limited.